How Kam Financial & Realty, Inc. can Save You Time, Stress, and Money.

How Kam Financial & Realty, Inc. can Save You Time, Stress, and Money.

Blog Article

See This Report on Kam Financial & Realty, Inc.

Table of ContentsThe Main Principles Of Kam Financial & Realty, Inc. Our Kam Financial & Realty, Inc. IdeasHow Kam Financial & Realty, Inc. can Save You Time, Stress, and Money.Kam Financial & Realty, Inc. - QuestionsWhat Does Kam Financial & Realty, Inc. Do?Kam Financial & Realty, Inc. Fundamentals Explained

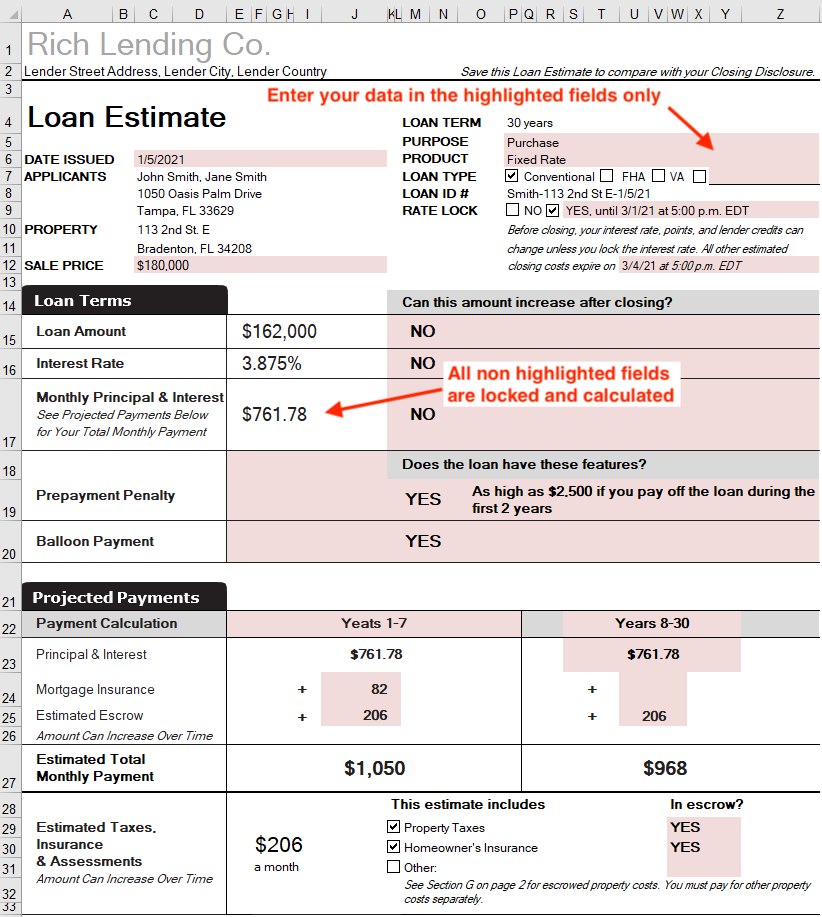

A mortgage is a car loan used to purchase or maintain a home, story of land, or other realty. The customer concurs to pay the loan provider in time, normally in a collection of normal repayments divided right into primary and passion. The property then functions as collateral to protect the finance.Mortgage applications undergo a rigorous underwriting procedure before they reach the closing stage. Mortgage kinds, such as standard or fixed-rate fundings, differ based upon the consumer's requirements. Home loans are car loans that are utilized to buy homes and various other kinds of property. The home itself functions as collateral for the finance.

The cost of a home mortgage will certainly rely on the kind of car loan, the term (such as thirty years), and the rate of interest that the lending institution fees. Mortgage prices can differ extensively relying on the kind of product and the credentials of the candidate. Zoe Hansen/ Investopedia Individuals and organizations use home mortgages to purchase property without paying the whole acquisition price upfront.

The Greatest Guide To Kam Financial & Realty, Inc.

Many traditional home mortgages are completely amortized. Regular home mortgage terms are for 15 or 30 years.

A property homebuyer pledges their residence to their lender, which then has an insurance claim on the property. This makes sure the lending institution's interest in the residential property should the purchaser default on their monetary commitment. When it comes to repossession, the lending institution may evict the citizens, market the residential or commercial property, and utilize the cash from the sale to repay the home loan debt.

The lender will certainly ask for proof that the customer is qualified of settling the financing. (https://www.awwwards.com/kamfnnclr1ty/)., and proof of present work. If the application is approved, the lending institution will use the borrower a finance of up to a certain amount and at a certain rate of interest price.

Unknown Facts About Kam Financial & Realty, Inc.

Being pre-approved for a home mortgage can give buyers an edge in a tight housing market since vendors will certainly recognize that they have the money to back up their offer. As soon as a buyer and seller agree on the terms of their deal, they or their agents will satisfy at what's called a closing.

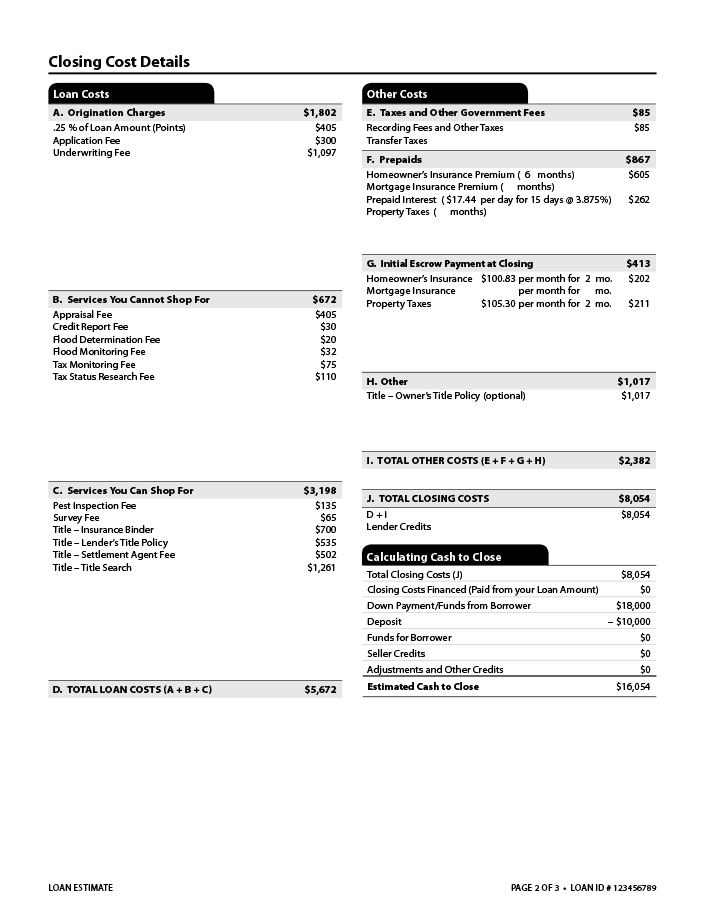

The seller will transfer ownership of the residential property to the purchaser and get the agreed-upon amount of money, and the purchaser will sign any kind of remaining home mortgage records. The lender may charge fees for originating the funding (occasionally in the kind of points) at the closing. There are hundreds of options on where you can get a home mortgage.

Little Known Questions About Kam Financial & Realty, Inc..

The basic type of mortgage is fixed-rate. A fixed-rate mortgage is additionally called a traditional mortgage.

Facts About Kam Financial & Realty, Inc. Uncovered

The whole lending equilibrium ends up being due when the borrower passes away, relocates away permanently, or sells the home. Within each kind of home loan, consumers have the choice to acquire price cut factors to buy their rate of interest down. Points are basically a fee that borrowers compensate front to have a lower passion price over the life of their lending.

Some Known Facts About Kam Financial & Realty, Inc..

How a lot you'll need to pay for a home loan relies on the type (such as taken care of or adjustable), its term (such as 20 or three decades), any discount points paid, and the rate of interest at the time. mortgage loan officer california. Rates of interest can vary from week to week and from lending institution to lender, so it pays to go shopping about

If you default and seize on your mortgage, nonetheless, the financial institution may come to be the brand-new owner of your home. The rate of a home is typically far above the amount of cash that the majority of families save. Therefore, home mortgages enable individuals and family members to purchase a home by placing down only a reasonably little down repayment, such as 20% of the acquisition cost, and obtaining a funding for the balance.

Report this page